I’ve said it before and I’ll say it again, the 2021 real estate market has been a head-turner! In the second half of 2020, once we started to emerge from the COVID lockdown, the real estate market started to bustle with activity. 2020 ended up being a robust real estate year driven by low interest rates and many COVID-influenced moves due to remote working and retirement. Who would have thought a global pandemic would have such a profound effect on the demand for real estate? Many people decided to retire and exit the state, many people entered our state and exited another, and a large portion of buyers who were no longer anchored by their commute followed their hearts to the suburbs and more rural locations.

When the calendar turned to 2021 the real estate market exploded! Inventory was depleted as 2020 did not provide the normal amount of new listings in tandem with a jump in demand. This combination created price escalations in 2021 that were beyond our wildest imagination. The price points for neighborhoods were re-established almost overnight with benchmark sales elevating the value proposition for the communities in which we live.

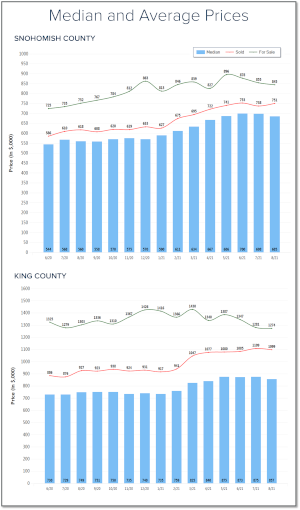

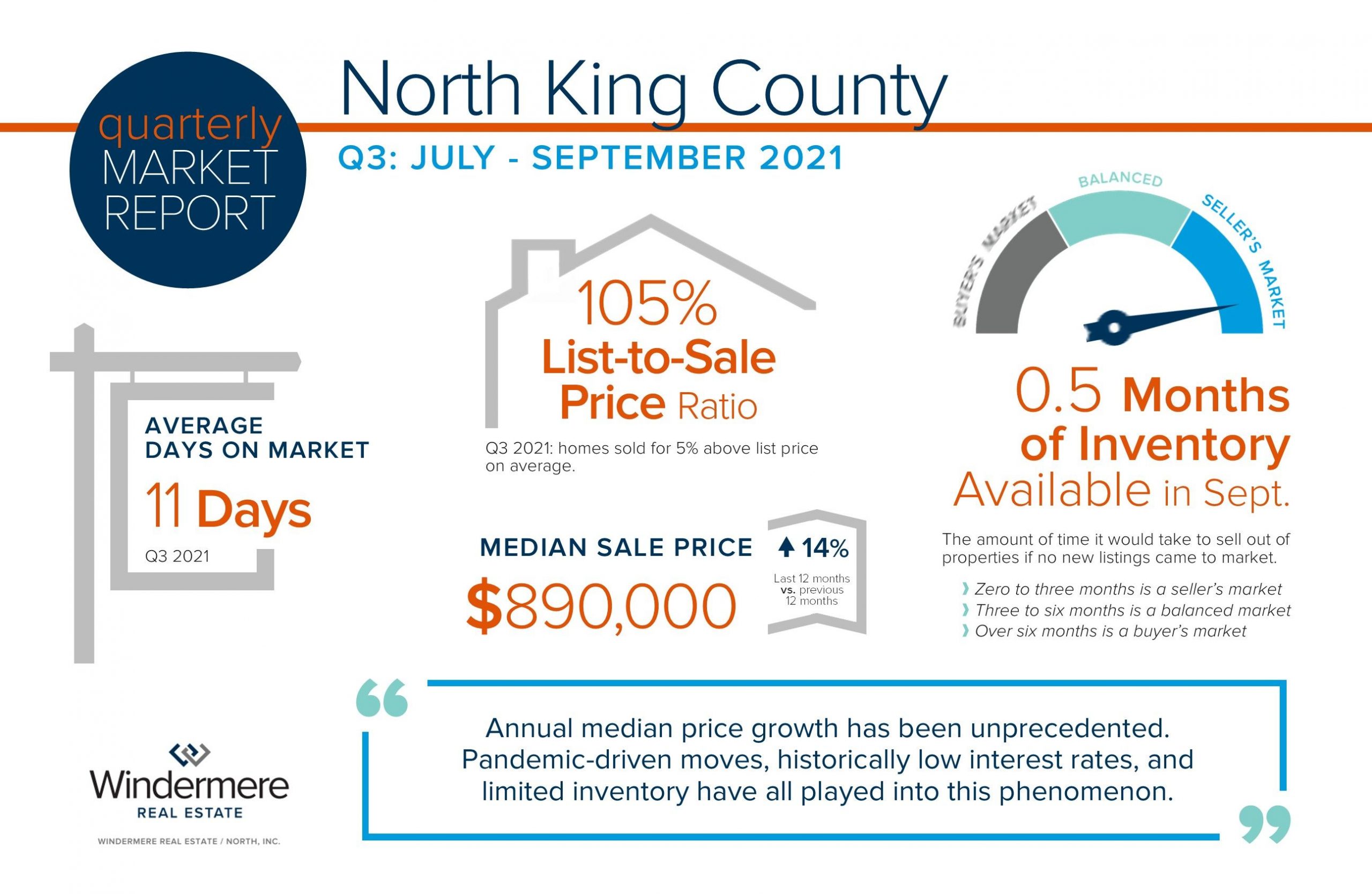

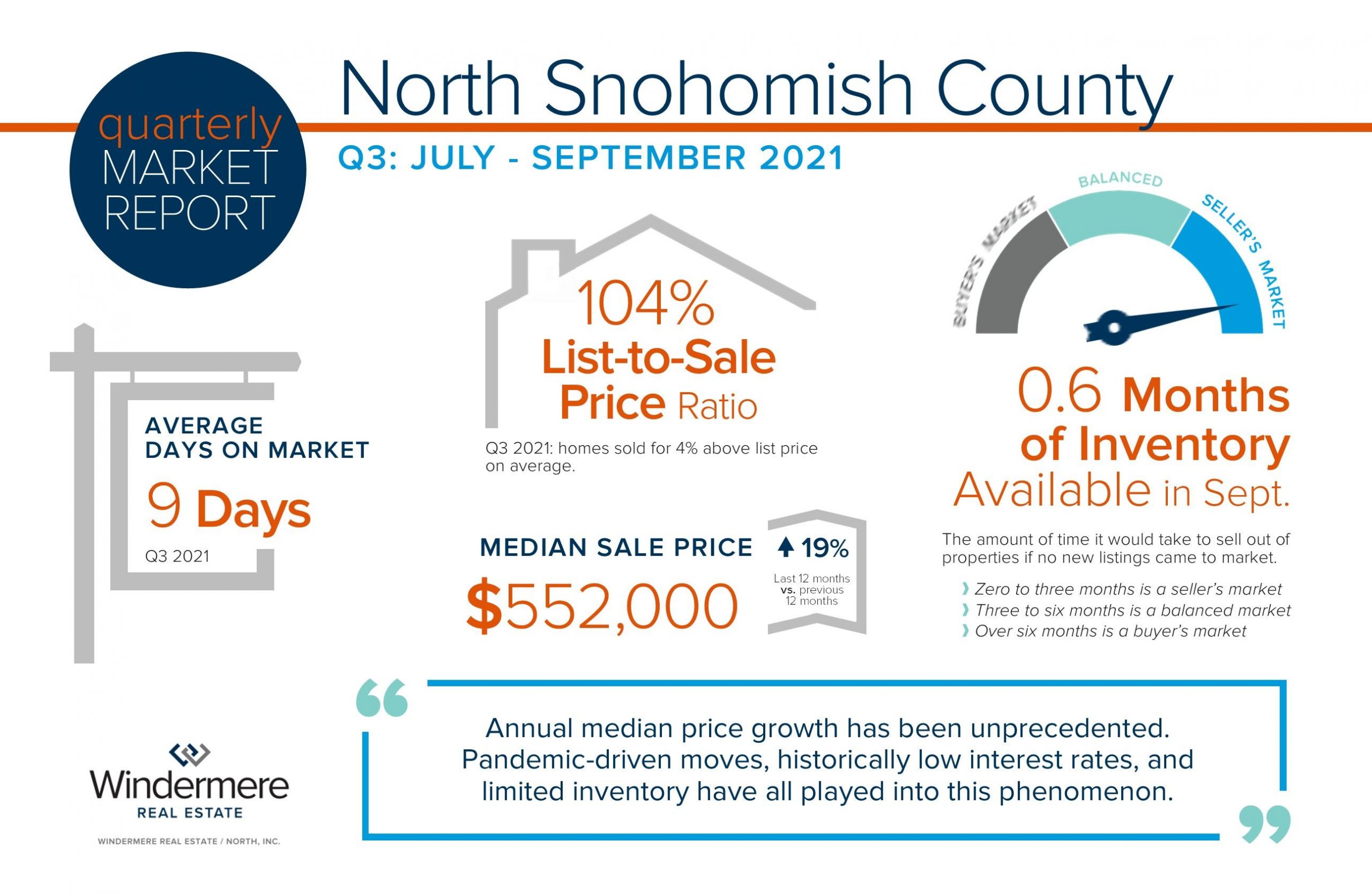

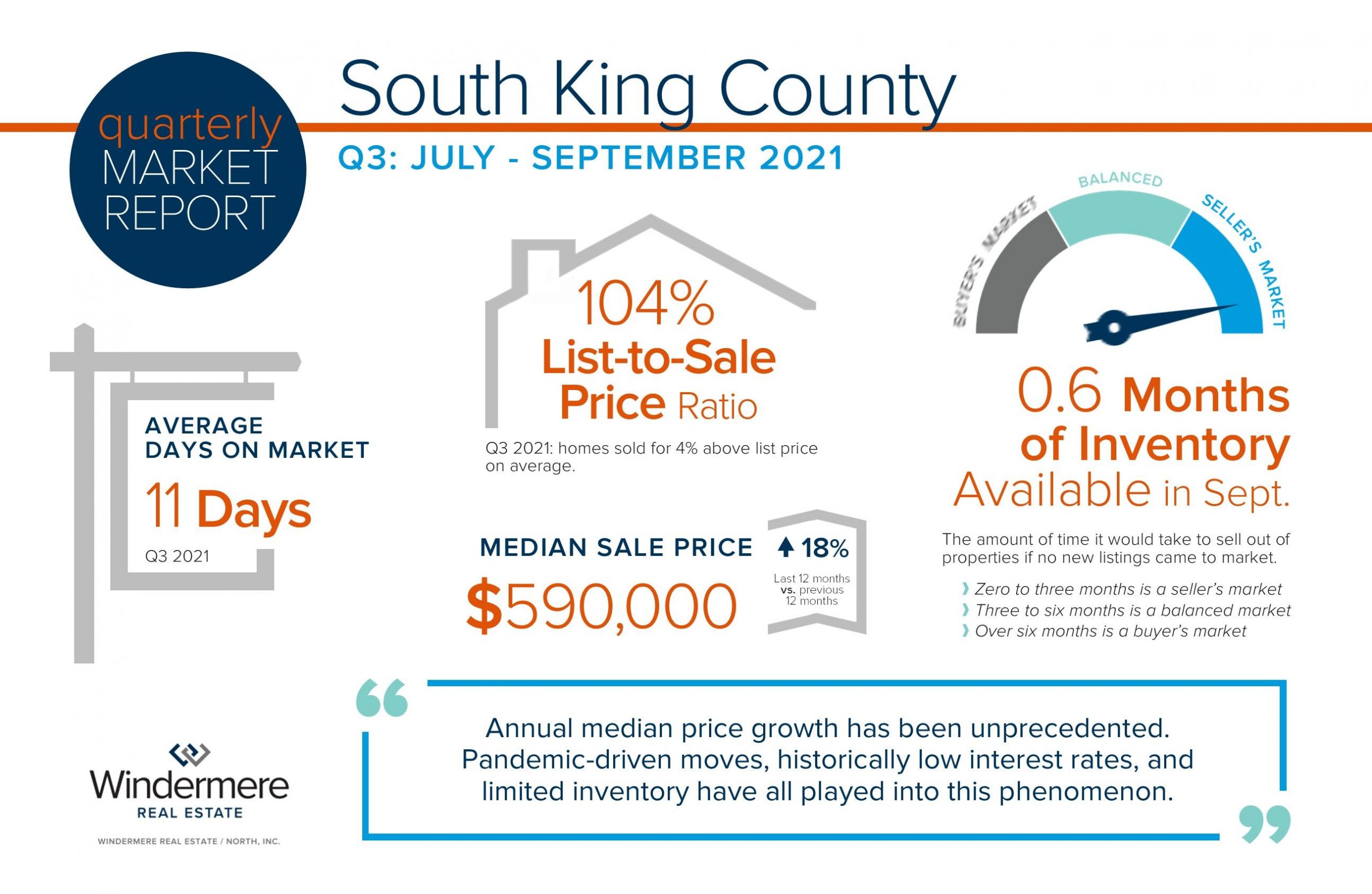

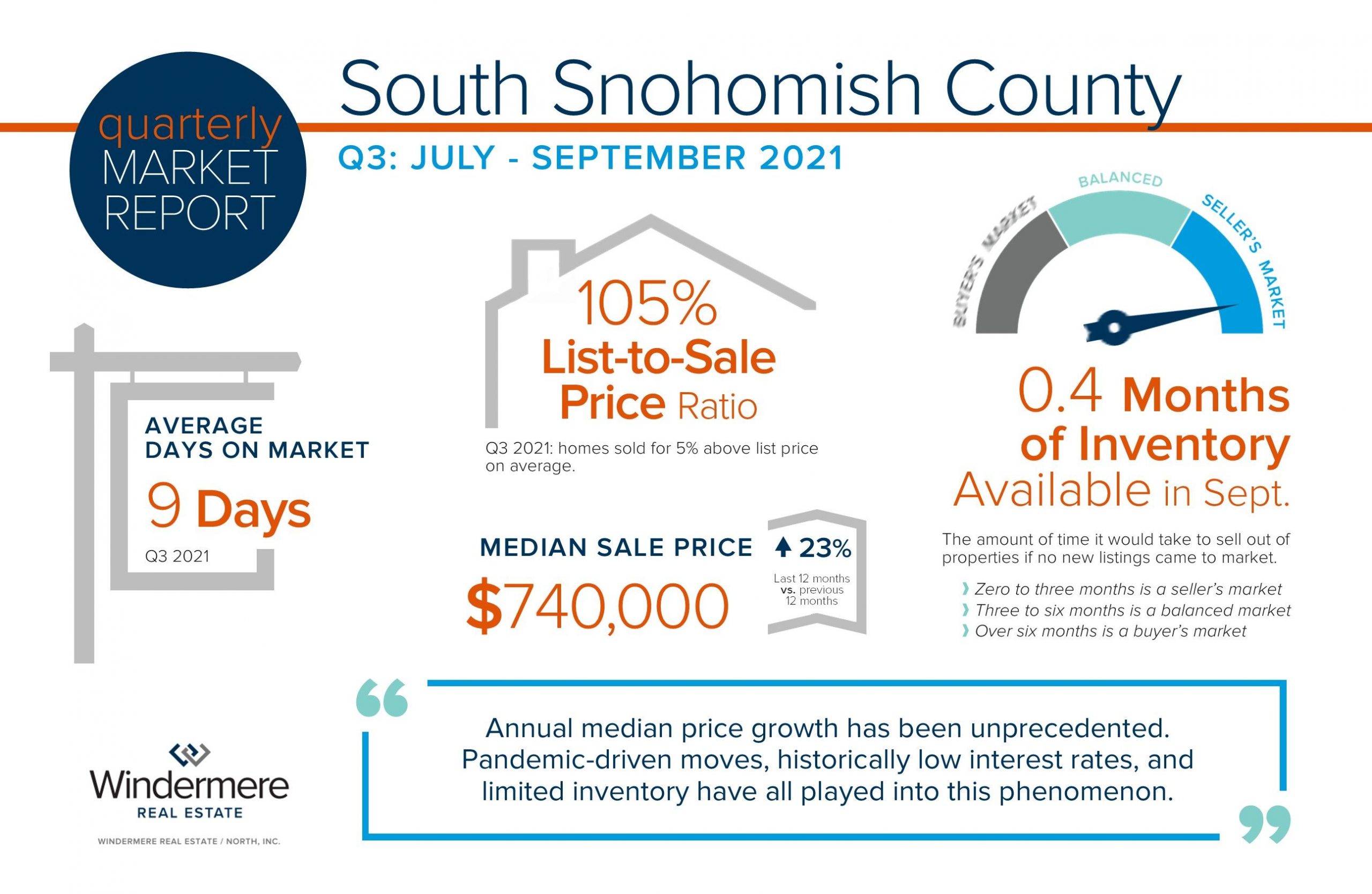

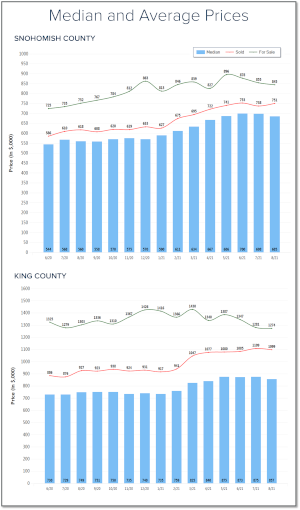

Seasonality has always had an effect on the market even in 2021. The first quarter of the year typically has the lowest amount of new listings as sellers make their way out of the short, dark days with soggy yards and projects on their to-do lists to prepare their properties for the spring market. The homes that sold in Q1 2021 saw above-normal gains over the list price. In fact, in Snohomish County, the average list-to-sale price ratio in March was 108%, and in King County 106%. As I mentioned earlier, almost overnight price appreciation established new home values for our communities.

Once the seasonal spring listings started to show themselves and buyers had additional selection, the price gains actually increased! The classic law of supply and demand relates the amount of supply against the amount of demand, and in turn provides a value. In the case of the 2021 spring market, the increase in supply actually was not enough to meet demand and put upward pressure on prices. Recorded sales from March to June saw the highest list-to-sale price ratios peaking at 110% on average in April in Snohomish County and at 108% in May in King County.

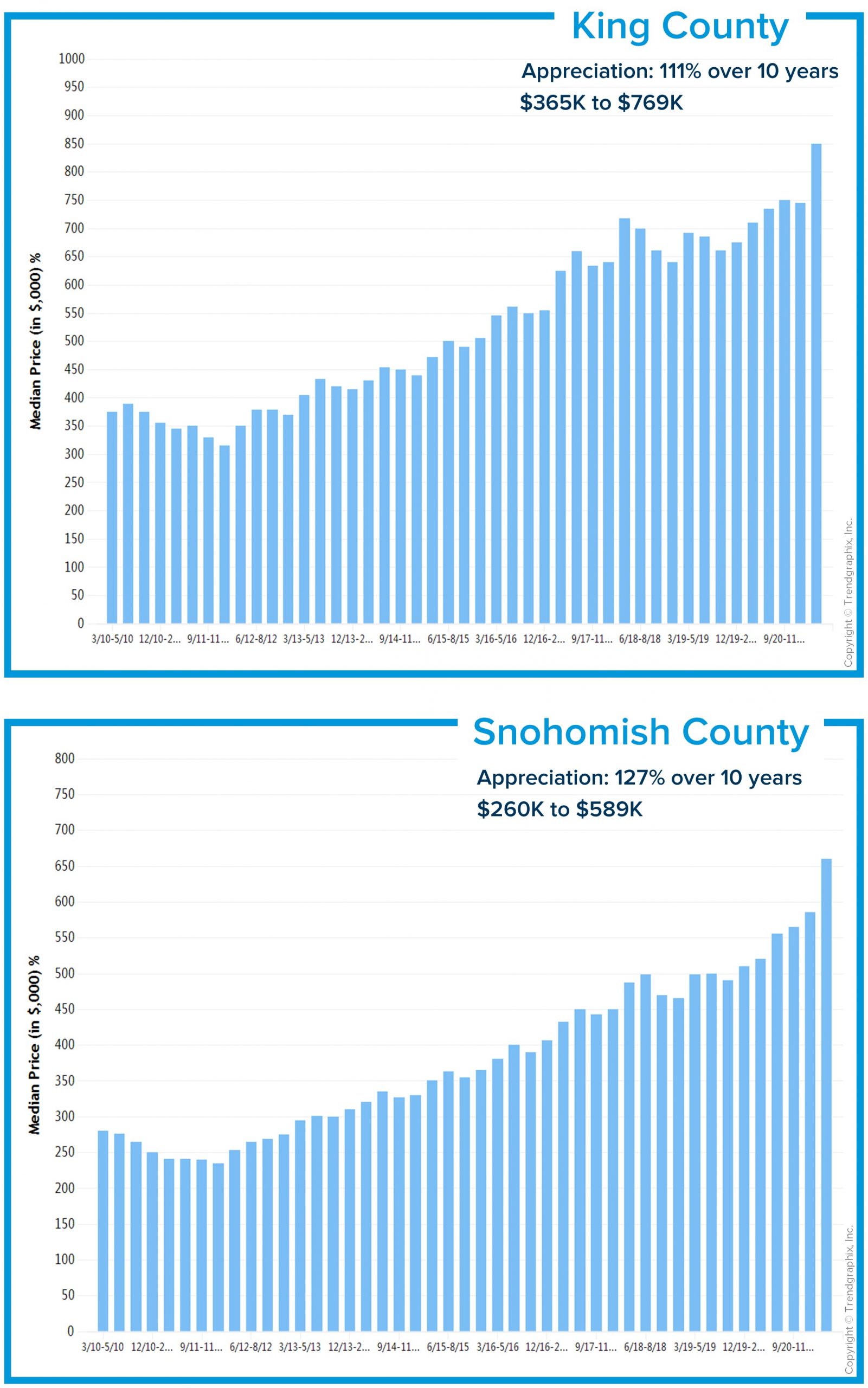

Since January the median price in Snohomish County has increased by 16% and in King County by 17%. Prices peaked in Snohomish County in June with the median price at $700,000 and in July in King County at $875,000. In August, both counties recorded prices 2% off the peak but were still sitting on top of a heap of price growth since the first of the year. Historically, markets will peak in the late spring, early summer as the ceiling of pricing starts to find itself. That appears to be where we are at. Although the figures this year have been intense and well above the norm, it is comforting to see typical seasonality still happening.

Since January the median price in Snohomish County has increased by 16% and in King County by 17%. Prices peaked in Snohomish County in June with the median price at $700,000 and in July in King County at $875,000. In August, both counties recorded prices 2% off the peak but were still sitting on top of a heap of price growth since the first of the year. Historically, markets will peak in the late spring, early summer as the ceiling of pricing starts to find itself. That appears to be where we are at. Although the figures this year have been intense and well above the norm, it is comforting to see typical seasonality still happening.

There is also this illusion that this type of market environment is easy. Yes, sales happen quickly and demand is high. I would be a fool to say that a sign in the yard and a feature on the internet couldn’t likely get a home sold. I must point out though that this market is nuanced and that obtaining the best results (top dollar and a smooth process) depends on how well all the steps are taken to prepare a property, price-position a property, and how carefully the negotiations and multiple offers are handled along the way by the broker. My office, Windermere North has continued to outperform the market in 2021 with shorter days on market and a higher list-to-sale price ratio than the market average. Check out our YTD comparison to the market averages to help understand how this elevated level of service makes a tangible difference for our clients.

As we head into fall and start to round out 2021, new homes that are coming to market are standing on the shoulders of the sales that took place earlier this year which created these increased home value levels. List-to-sale price ratios are starting to decrease as sellers are stair-stepping their pricing based on the freshly recorded home sales and the market is finding its peak for the year. Sellers that expect to stair-step and to escalate like homes did earlier in the year may find themselves disappointed and overpriced.

We are starting to see market times increase and expect a small surge in fall listings to help satisfy the buyer demand that remains. Low interest rates continue to provide buyers the flexibility to make moves with minimal debt service. As long as rates remain low, demand will continue. The good news is, not every home sale is a multiple-offer frenzy like we saw at the beginning of 2021. The new normal has established itself and buyers are becoming more savvy navigating this market. In my next newsletter, I will outline some expert buyer tools that have helped buyers succeed in this market.

The remainder of 2021 should complete a banner year in real estate. Sellers have made amazing returns and buyers are obtaining homes that better match their lifestyle goals with low debt service. COVID shook up how we value where we live. Remote work increased the value of our suburbs, retirees pushed prices in rural locations, and people having more time to reflect, shifted how they prioritize their homes’ features. Some folks even “got out” of Washington, but it wasn’t a mass exodus, as just as many are leaving other states for ours.

I see this last year and a half as a re-organization of our communities through housing, which comes with some positives and some negatives. Change can be uncomfortable, but change is certain. 2021 has been a year unlike any other! Seasonality, research, and relationships have been the stable markers that have helped me help my clients find success in this new environment and have helped me navigate some occasional choppy waters along the way. It is always my goal to help keep my clients well informed and empower strong decisions. Please reach out if you’d like to learn more about how the current market relates to your goals. If you know of anyone who needs real estate help, I would be honored to help take care of them as well.

All of us at Windermere Real Estate are proud to kick off another season as the “Official Real Estate Company of the Seattle Seahawks.” Since 2016, we’ve partnered with the Seahawks to #TackleHomelessness by donating $100 for every Seahawks defensive tackle made in a home game. And for the third season in a row, the money raised will go to Mary’s Place, a non-profit organization dedicated to supporting homeless families in the greater Seattle area. Mary’s Place works to provide safe and inclusive shelter and services that support women, children, and families through their journey out of homelessness.

Mary’s Place’s mission and the work of the Windermere Foundation go hand-in hand. At the last home game, we were able to donate $6,300, which brought our #TackleHomelessness total to $166,600 adding to our donations over the past five seasons. We look forward to raising even more this year!

Go Hawks!

The Windermere Ready Loan allows our home sellers to receive access to funds to make home improvements and merchandise their homes for the market with no upfront cost. Clients can borrow up to $50,000 as long as the Windermere Ready Loan and any other encumbrances on the property do not exceed 75% of the market value. With the majority of Puget Sound cities having experienced 15-25% in price appreciation over the last year or two, this loan-to-value ratio is very manageable.

The Windermere Ready Loan allows our home sellers to receive access to funds to make home improvements and merchandise their homes for the market with no upfront cost. Clients can borrow up to $50,000 as long as the Windermere Ready Loan and any other encumbrances on the property do not exceed 75% of the market value. With the majority of Puget Sound cities having experienced 15-25% in price appreciation over the last year or two, this loan-to-value ratio is very manageable.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

Since January the median price in Snohomish County has increased by 16% and in King County by 17%. Prices peaked in Snohomish County in June with the median price at $700,000 and in July in King County at $875,000. In August, both counties recorded prices 2% off the peak but were still sitting on top of a heap of price growth since the first of the year. Historically, markets will peak in the late spring, early summer as the ceiling of pricing starts to find itself. That appears to be where we are at. Although the figures this year have been intense and well above the norm, it is comforting to see typical seasonality still happening.

Since January the median price in Snohomish County has increased by 16% and in King County by 17%. Prices peaked in Snohomish County in June with the median price at $700,000 and in July in King County at $875,000. In August, both counties recorded prices 2% off the peak but were still sitting on top of a heap of price growth since the first of the year. Historically, markets will peak in the late spring, early summer as the ceiling of pricing starts to find itself. That appears to be where we are at. Although the figures this year have been intense and well above the norm, it is comforting to see typical seasonality still happening.